CNBC highlights Carrington's new Non-Prime programs with Rick Sharga

See what Rick Sharga, Executive Vice President of Carrington Mortgage Holdings has to say about Carrington's new Non-Prime loan programs, in this CNBC video clip.

See what Rick Sharga, Executive Vice President of Carrington Mortgage Holdings has to say about Carrington's new Non-Prime loan programs, in this CNBC video clip.

Last Week in Review:

March job growth came in lower than expected, while home prices continue to rise.

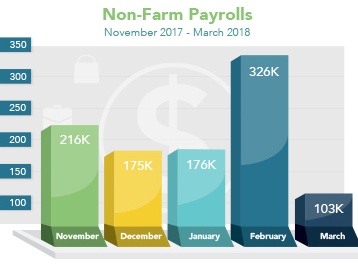

Just 103,000 jobs were created in March, much lower than the 175,000 expected, the Bureau of Labor Statistics reported. February's report was revised higher to 326,000 new jobs from 313,000, while January was revised lower to 176,000 from 239,000. The Unemployment Rate was unchanged at 4.1 percent.

Average hourly earnings came in at 0.3 percent, higher than expectations. Annual wage growth ticked up to 2.7 percent in March from 2.6 percent for the 12 months ending in February. The first quarter of 2018 also saw higher job growth than the same period last year, as an average of 202,000 new jobs were created in the first three months of 2018 compared to 177,000 in 2017. Overall, despite the disappointing headline number, there was some positive news in the report.

In housing news, home prices continued to push higher in February due in part to the ongoing theme of limited housing supply on the markets. Research firm CoreLogic reported that home prices, including distressed sales, rose 6.7 percent from February 2017 to February 2018 and were up 1 percent from January to February. Looking ahead, CoreLogic forecasts that home prices will rise 4.7 percent from February 2018 to February 2019.

Extreme volatility continued in the markets this week, as uncertainty regarding tariffs and a trade war with China caused wild swings in Stocks. Mortgage Bonds were stuck in a sideways trading pattern, while home loan rates remain historically attractive.

If you or someone you know has any questions about home loan products, please give us a call. We'd be happy to help.

Last Week in Review:

GDP edged lower in fourth quarter 2017, while inflation remained tame in February.

Fourth quarter 2017 Gross Domestic Product (GDP) edged lower to 2.9 percent, down from 3.2 percent in the third quarter, the Bureau of Economic Analysis reported. However, the report showed that consumer spending rose 4.0 percent, up from 2.2 percent in the third quarter. The jump in consumer spending was the quickest pace since the fourth quarter of 2014. Consumer spending makes up two-thirds of economic activity and is a key driver of economic growth.

Home prices continued to rise in January due in part to the low amount of homes for sale on the markets. The S&P/Case-Shiller 20-City Home Price Index rose 6.4 percent from January 2017 to January 2018, up from 6.3 percent recorded from December 2016 to December 2017. Home prices were also up 0.8 percent from December to January. Inventory continues to be a real challenge for many would-be buyers. Currently, there is a 3.4-month supply of homes for sale, well below the 6-month supply that is seen in a healthy market.

Consumer inflation remained low in February. The Bureau of Economic Analysis reported that Personal Consumption Expenditures (PCE) and Core PCE rose 0.2 percent from January to February, both in line with estimates. The more closely watched Core PCE reading excludes volatile food and energy prices and February's figure was just below the 0.3 percent recorded in January. From February 2017 to February 2018, Core PCE came in at 1.6 percent, just above the 1.5 percent recorded in January. However, the reading is still well below the Fed's target range of 2 percent.

When inflation starts to rise, a rise in home loan rates can follow. Inflation reduces the value of fixed investments like Mortgage Bonds, and home loan rates are tied to Mortgage Bonds.

For now, home loan rates remain attractive and near historically low levels.

If you or someone you know has any questions about home loans, please reach out. We'd be happy to help.

Effective for Non-Prime Primary Residence and Second Home loans with applications taken on and after Monday, April 2, 2018, Carrington Mortgage Services, LLC (CMS) will introduce the following guideline enhancements:

In addition to the enhancements above, the Non-Prime program will have the following additional guideline changes:

All loans with APPLICATIONS on and after Monday April 2, 2018 must comply with the new Non-Prime Underwriting Guidelines. All loans with Applications prior to Monday April 2, 2018 must be fulfilled using the prior Non-Prime Underwriting Guidelines.

[one_third]

[btn link="/become-approved" color="crimson"]Become an Approved Broker[/btn]

[/one_third]

[one_third]

[btn link="https://brokeriq.carringtonwholesale.com/login/login.php" color="crimson"]Login to BrokerIQ[/btn]

[/one_third]

[one_third_last]

[btn link="/loan-products/" color="crimson"]View the Guidelines and Matrix[/btn]

[/one_third_last]

Carrington Mortgage Services, LLC (CMS) is pleased to announce the addition of a new appraisal vendor, CoesterVMS Nationwide Appraisal Management and Valuation Services, effective March 30, 2018. Coester VMS is a nationwide appraisal management company and provides lenders with the most accurate valuations.

As of the effective date, Coester VMS will be live in Smart fees and Retail Associates will be able to place orders through the Mercury Network.

CoesterVMS Contact Information

Website: www.coestervms.com

Address: 7529 Standish Place, Suite 200 Rockville, MD 20855

Toll-Free: (888) 485-1999

Email: Partners@coestervms.com

Last Week in Review:

Sales of new and existing homes showed different results in February while the Fed raised the Fed Funds Rate.

February Existing Home Sales rose 3 percent from January to an annual rate of 5.54 million, above the 5.42 million expected, the National Association of REALTORS® (NAR) reported. Gains were seen in the South and West with declines in the Northeast and Midwest. Sales were up 1.1 percent from a year ago. Unsold inventory is at a 3.4-month supply, well below the 6-month supply that is seen as normal.

Sales of new homes had the opposite result in February, falling for the third straight month. New Home Sales edged lower by 0.6 percent from January to an annualized rate of 618,000, just below expectations, the Commerce Department reported. Sales increases were seen in the Northeast and South, with declines in the Midwest and West. New Home Sales were up 0.5 percent from February 2017 to February 2018. And there was good news regarding inventory. There was a 5.9-month supply of new homes for sale on the market, which is near the 6-month supply seen as normal.

The Fed also made headlines in the latest week. As expected, the Fed raised its benchmark Federal Funds Rate 0.25 percent, bringing the new target rate range to between 1.5 and 1.75 percent. The Fed acknowledged inflation remains low, but it is expected to rise in the coming months as tax cuts further stimulate the economy.

If inflation does begin to rise, an increase in home loan rates could follow. Inflation reduces the value of fixed investments like Mortgage Bonds, and home loan rates are tied to Mortgage Bonds. However, many factors impact the direction of the markets, including possible tariffs, trade wars and the direction of other economic reports. We'll continue to monitor all of these developments closely.

In the meantime, home loan rates remain historically attractive.

If you or someone you know has any questions about home loan rates or products, please reach out. We'd be happy to help.

Want to know what’s in store for the real estate and mortgage industries in 2018? Will low inventory, rising rates, and falling affordability derail the housing recovery? Get the answers to these and other questions in an informative webinar hosted by Rick Sharga, Executive Vice President, Carrington Mortgage Holdings, on the State of the U.S. Housing Market. Rick will share insights on US Economic Performance, Home Sales Trends, Mortgage Industry Trends and what the outlook is for the real estate market for the rest of 2018. We’ll also cover current events such as immigration policy and tax reforms, and their potential impact on the market. Don’t miss this great opportunity to get informed. Register now to save your spot!

[btn link="https://register.gotowebinar.com/register/5094560028901478658?source=CW.com" color="royalBlue" size="size-xl"]Register Now[/btn]

Carrington Mortgage Services, Wholesale Lending division is implementing an $85 Tax Service fee.

For loans where Carrington discloses, the $85 tax fee will be automatically included. This is effective immediately.

For Broker Disclosed loans, we ask that you begin disclosing this fee right away. As of June 1st, 2018 loans we will be rejecting submissions that do not include the disclosed fee.

Please contact your Account Executive with questions.

The Carrington Mortgage Services, LLC (CMS) Lock Desk will close early at 11:00 AM Pacific Time on Friday, March 30, 2018 for Good Friday. Normal lock hours will resume on Monday, April 2, 2018.

View on FoxBusiness.com.

An Equal Housing Opportunity Lender. Copyright 2007 -

2025

. Carrington Mortgage Services, LLC headquartered at 1600 South Douglass Road, Suites 110 & 200-A, Anaheim, CA 92806. NMLS ID # 2600. Toll Free # 800-561-4567. All rights reserved. Restrictions may apply. All loans are subject to credit, underwriting and property approval guidelines. Nationwide Mortgage Licensing System (NMLS) Consumer Access Web Site: www.nmlsconsumeraccess.com.

The content of this website is intended for licensed third-party originators or brokers only and may not be duplicated or disseminated to the public. Carrington Mortgage Services, LLC is one of the leading wholesale mortgage lenders.

Government Agency Approval | FHA Non-Supervised Mortgage Approval #: 24751-0000-5 | VA Automatic Lender Approval #: 902324-00-00