Last Week in Review: Non-farm payrolls rose in August. So did home prices in July.

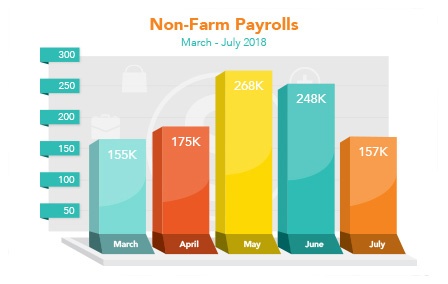

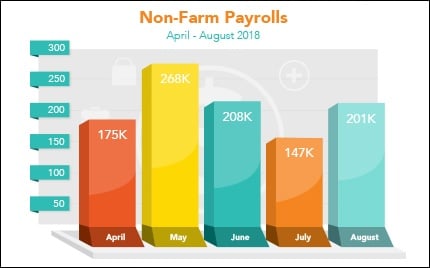

U.S. employers hired 201,000 new workers in August, above the 187,000 expected, the Bureau of Labor Statistics reported. However, June and July were revised lower by a total of 50,000 jobs. Job gains have averaged 185,000 per month over the last 3 months. The Unemployment Rate remained at 3.9 percent.

Perhaps the biggest news within the report was the 0.4 percent gain in wages from July to August, while year-over-year wages increased by 2.9 percent, the highest annual increase in nine years. Overall, this was a solid report as the labor sector is at or near what's considered full employment.

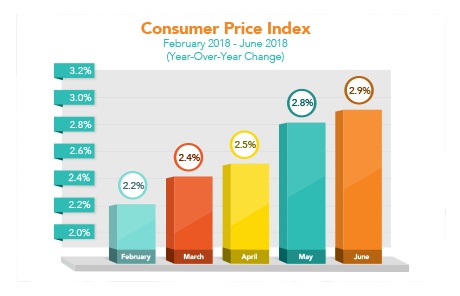

Home prices rose at a solid pace in July. Research firm CoreLogic reported that home prices, including distressed sales, were up 6.2 percent from July 2017 to July 2018 and 0.3 percent from June to July of this year. Frank Nothaft, CoreLogic's chief economist, noted that gains are beginning to moderate due in part to higher home loan rates and home prices. CoreLogic forecasts that home prices will rise 5.1 percent from July 2018 to July 2019.

Mortgage Bonds fell in the latest week, especially after the strong labor market news. Home loan rates remain historically attractive.

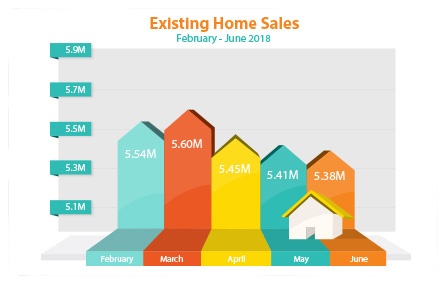

Existing Home Sales decreased 0.7 percent to a seasonally adjusted annual rate of 5.34 million in July from 5.38 million in June, the National Association of REALTORS® reported. This was their slowest pace in more than two years and 1.5 percent lower than July 2017. Sales have also declined on an annual basis for five straight months. Losses were seen in the Northeast, Midwest and South, with gains in the West. Unsold inventory is at a 4.3-month supply, well below the 6-month supply seen as normal.

Existing Home Sales decreased 0.7 percent to a seasonally adjusted annual rate of 5.34 million in July from 5.38 million in June, the National Association of REALTORS® reported. This was their slowest pace in more than two years and 1.5 percent lower than July 2017. Sales have also declined on an annual basis for five straight months. Losses were seen in the Northeast, Midwest and South, with gains in the West. Unsold inventory is at a 4.3-month supply, well below the 6-month supply seen as normal.

Research firm CoreLogic reported that home prices, including distressed sales, rose 6.8 percent from June 2017 to June 2018. Prices were up 0.7 percent from May to June. However, gains could slow over the next year if further increases in home prices and home loan rates erode affordability. CoreLogic forecasts a 5.1 percent increase in home prices from June 2018 to June 2019.

Research firm CoreLogic reported that home prices, including distressed sales, rose 6.8 percent from June 2017 to June 2018. Prices were up 0.7 percent from May to June. However, gains could slow over the next year if further increases in home prices and home loan rates erode affordability. CoreLogic forecasts a 5.1 percent increase in home prices from June 2018 to June 2019.