Annual Inflation Heating up

Last Week in Review:

Annual inflation ticked up while small business optimism neared record highs.

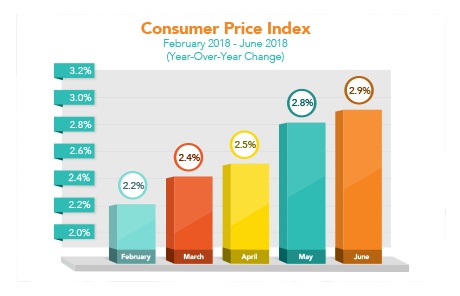

The Consumer Price Index (CPI) rose 2.9 percent in the 12 months ending in June, up slightly from the 2.8 percent annual reading in May. This was the largest annual increase since the year ending in February 2012, and it was led higher by energy costs. On a monthly basis, CPI increased 0.1 percent in June. Core CPI, which strips out volatile food and energy prices, rose 0.2 percent in June and was up 2.3 percent year over year.

The Producer Price Index (PPI), which measures wholesale inflation, rose 3.4 percent year over year in June, the largest increase in more than six years. The rise was also due in part to increasing energy prices. From May to June, PPI was up 0.3 percent.

Rising inflation is always a concern for fixed investments, like Mortgage Bonds, since inflation reduces their value. Home loan rates are tied to Mortgage Bonds, so they are negatively impacted when Mortgage Bonds worsen. However, many factors influence the markets. For example, if trade issues heat up, Bonds could benefit at the expense of Stocks if investors seek a safer haven for their money.

In the latest week, Stocks benefited from positive earnings and the news that the NFIB Small Business Optimism Index remained near record highs in June. Mortgage Bonds and home loan rates remain attractive and near their best levels historically.