Retail Sales Rise

Last Week in Review:

Retail Sales were on the rise while inflation showed some warming signs. The Fed also hiked its benchmark rate.

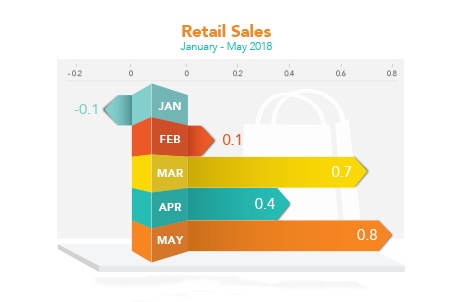

The Commerce Department reported that Retail Sales jumped 0.8 percent from April to May, well above the 0.4 percent expected. From May 2017 to May 2018, Retail Sales were up 5.9 percent. When stripping out autos, Retail Sales jumped 0.9 percent. If consumer spending continues in a similar fashion, the U.S. economy will continue to grow at a solid pace in the months ahead.

As expected, the Fed raised the benchmark Federal Funds Rate by 0.25 percent, bringing the new target range to 1.75 to 2 percent. The Fed Funds Rate is the short-term rate at which banks lend money to each other overnight. It is not directly tied to long-term rates on consumer products like purchase or refinance home loans. The Fed noted that the economy is doing well and that investors should look for four increases to the Fed Funds Rate this year, up from the three previously mentioned.

The Fed also raised the inflation forecasts for 2018 and 2019. The May Producer Price Index, which measures wholesale inflation, rose 3.1 percent on an annual basis, the largest increase since January 2012.

The more closely watched Consumer Price Index (CPI) rose 2.8 percent annually. Core CPI, which strips out volatile food and energy prices, rose 2.2 percent annually. However, the monthly CPI reading was a bit muted, showing inflation rose 0.2 percent from April to May, below expectations.

The key takeaway is that inflation reduces the value of fixed investments like Mortgage Bonds. Since home loan rates are tied to Mortgage Bonds, rising inflation could lead to an uptick in rates, which is why inflation data is always important to monitor.

For now, home loan rates remain near historic lows.