Consumer Price Index lower than expectations

Last Week in Review:

Rates were higher early in the week - but improved on the heels of a soft Consumer Inflation reading and rout in Stocks.

When following the direction of interest rates, one only has to follow the direction of inflation. If inflation is moving higher, rates are going higher. The opposite is also true.

Lately, there has been a growing fear that inflation is threatening to rise due to our tight labor market, strong economy and rising wages. It was this fear that pushed rates higher over the past month, culminating with rates hitting their highest level in over 7 years this past Tuesday.

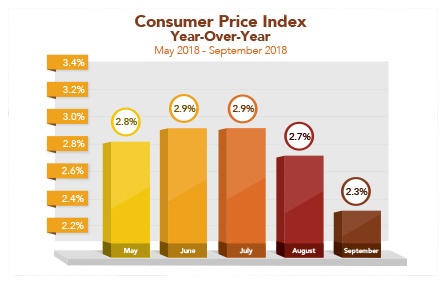

But come Thursday - the bond market had reason to breathe a sigh of relief and rejoice when the September Consumer Price Index (CPI) was reported lower than expectations. Remember - low inflation is good for the bond market and home loan rates.

It was just last month that Fed Chairman Jerome Powell and the Fed forecasted consumer inflation to remain near current levels through 2021. If this comes to pass, long-term rates like home loan rates can't rise too much.

Also helping rates improve from the worst levels of the week was a 1,400+ point selloff in Stocks between Wednesday and Thursday. Generally speaking, when investors sell Stocks they park some of those investment dollars into Bonds.

Bottom line - home loan rates, while elevated since earlier this year, remain historically low...especially when you consider how well our economy is performing.