Home Prices Continue to Rise

Last Week in Review:

Job growth eased in July while annual inflation remained tame in June and home prices continued to rise.

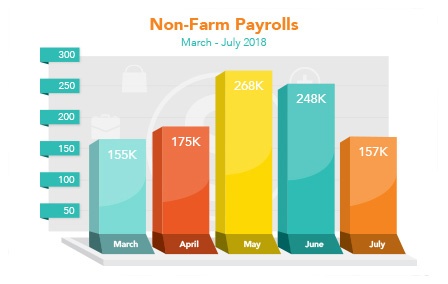

Non-Farm Payrolls rose by 157,000 new jobs in July, below the 190,000 expected, the Bureau of Labor Statistics reported. However, the figures for May and June were revised higher by a total of 59,000 new jobs. The Unemployment Rate also fell to 3.9 percent. For the past three months, job growth has averaged 224,000 compared to 195,000 in the same period in 2017. Hobby and retail toy employment fell by 32,000 jobs in July, largely due to the closing of Toys R Us, which hurt headline Non-Farm Payrolls and could be a one-off number. Overall, the labor market continues to produce solid numbers.

Home prices rose steadily across the nation in May. The S&P CoreLogic Case-Shiller 20-City Home Price Index rose 6.5 percent from May 2017 to May 2018. This was in line with expectations and just below the 6.7 percent recorded in April. On a monthly basis, home prices were up 0.7 percent from April to May.

The Fed met and left its benchmark Fed Funds Rate unchanged, as expected. This is the rate banks use to lend money to each other overnight, and it does not directly impact home loan rates. The Fed noted that economic activity is growing at a strong rate and the labor market continues to strengthen.

If these strong signs for the economy continue, Stocks could benefit at the expense of Mortgage Bonds and the home loan rates tied to them. However, many factors impact both Stocks and Bonds, so it's important to keep an eye on the overall picture. For instance, low inflation is typically good news for fixed investments like Mortgage Bonds, and the annual Core Personal Consumption Expenditures edged lower to 1.9 percent in June. This was down from the 2 percent recorded in May and below the Fed's 2 percent target range.

For now, home loan rates remain attractive and near historically low levels.