Job Growth Heats Up in May

Last Week in Review:

Geopolitical headlines moved the markets. May job growth beat expectations.

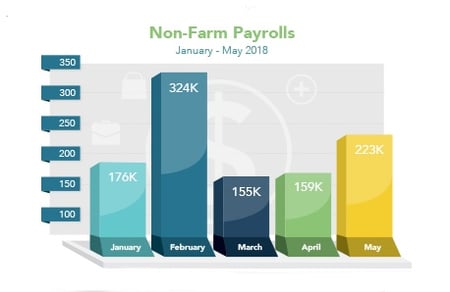

The Bureau of Labor Statistics reported that Non-Farm Payrolls rose 223,000 in May, above expectations and up from 159,000 in April. April and March were revised for an increased total of 15,000 more jobs than previously reported. May Average Hourly Earnings also rose 0.3 percent, in line with estimates, and up from 0.1 percent in April. Year over year, earnings were up 2.7 percent in May, from the 2.6 percent for the year ended in April. The Unemployment Rate for May fell to 3.8 percent, the lowest level since April 2000. Overall, the Jobs Report was strong and shows a strengthening labor market.

The Bureau of Labor Statistics reported that Non-Farm Payrolls rose 223,000 in May, above expectations and up from 159,000 in April. April and March were revised for an increased total of 15,000 more jobs than previously reported. May Average Hourly Earnings also rose 0.3 percent, in line with estimates, and up from 0.1 percent in April. Year over year, earnings were up 2.7 percent in May, from the 2.6 percent for the year ended in April. The Unemployment Rate for May fell to 3.8 percent, the lowest level since April 2000. Overall, the Jobs Report was strong and shows a strengthening labor market.

Annual Core Personal Consumption Expenditures (PCE) showed that inflation rose 1.8 percent in April, while March was revised lower to 1.8 percent from 1.9 percent. Core PCE, which excludes volatile food and energy prices, is the Fed's favorite inflation gauge. While inflation remains steady, it is still below the Fed's 2 percent target. Since inflation reduces the value of fixed investments, like Mortgage Bonds, it can hurt Mortgage Bonds and the home loan rates tied to them. It will be important to see where inflation heads in the coming months.

In housing news, home prices continued to edge higher in March due in a large part to low inventories of homes for sale on the market. The S&P Case-Shiller 20-City Home Price Index rose 6.8 percent from March 2017 to March 2018, matching the February gain.

Although the second reading on first quarter 2018 Gross Domestic Product was also released last week, it came and went with little fanfare, near unchanged from the first reading. The real market mover was the geopolitical events throughout Europe. Political turmoil in Italy and Spain pushed investors into the safe haven of the Bond markets early in the week, but those fears eased in recent days as both countries came to an agreement.

Mortgage Bonds were able to squeak out small gains in the latest week as they rose to near 2018 highs. Home loan rates declined and remain historically attractive.